Ad

Join Binance today and start trading!

One of the world’s largest crypto platforms, offering low fees and a wide selection of coins to trade.

BTC Live Price (USDT)

Day 4 – Why the Market Freaks Out (and What Really Moves Prices)

Welcome to the part of trading where numbers meet news, and logic sometimes goes out the window.

Today you’ll see why even the prettiest chart can get wrecked by a single tweet or an unexpected announcement.

It’s time to talk fundamentals — the stuff happening outside the chart that makes the candles dance.

What Is Fundamental Analysis?

If technical analysis is reading a chart,

fundamental analysis is reading the world behind it.

It’s about understanding why prices move — not just how.

Think of it like the weather:

Charts tell you it’s raining.

Fundamentals tell you why the clouds showed up.

The Main Forces That Shake the Market

Let’s break the chaos into something you can actually grasp.

1. News & Announcements

- Government regulations

- Exchange hacks

- Company partnerships

- Elon Musk saying literally anything

The market reacts fast — often before you even finish reading the headline.

2. Economic Data & Interest Rates

Crypto doesn’t live in a bubble.

When interest rates rise, investors move money to safer assets.

When rates drop, people start feeling brave (or greedy).

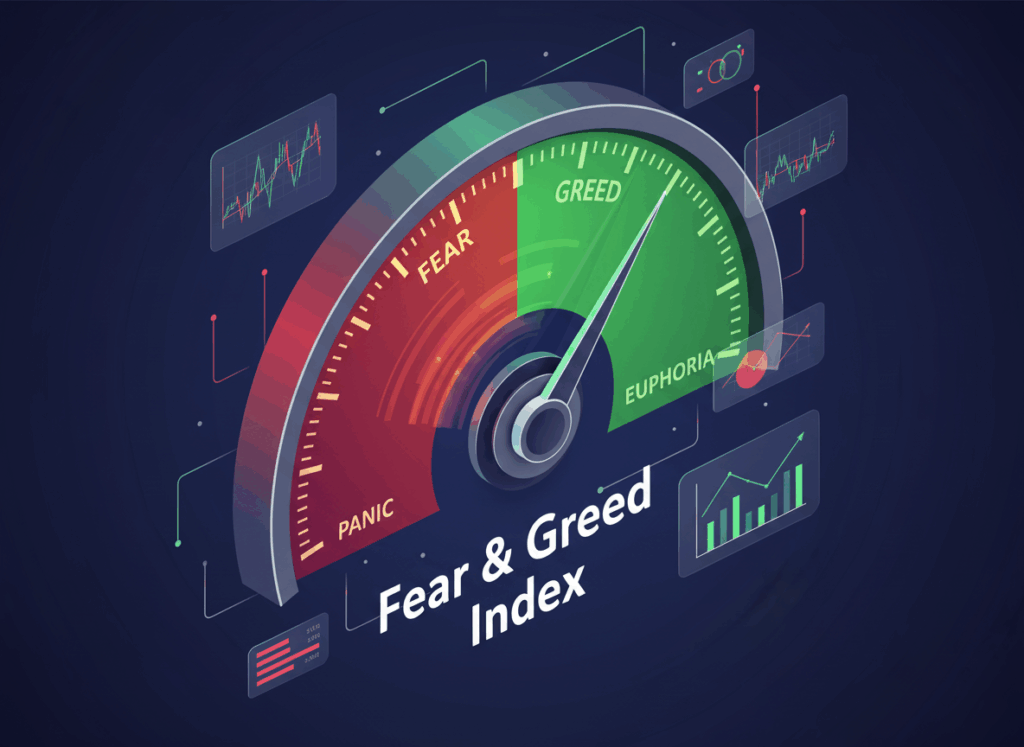

3. Sentiment (a.k.a. Vibes)

Sometimes logic takes a day off.

If everyone feels bullish, they buy.

If fear spreads, everyone sells.

Sites like the Fear & Greed Index literally track this emotional rollercoaster.

Unspoken Factors Pros Always Watch

These don’t make headlines but can flip markets upside down:

- Liquidity – if there’s not enough money flowing, prices move erratically.

- Whales – big holders (funds, institutions, OG traders) can move the market with one trade.

- Funding Rate – in futures markets, it balances longs vs. shorts. If it spikes, someone’s getting squeezed.

- Open Interest – shows how many contracts are active. A sudden drop = massive liquidations just happened.

These are like the vital signs of the market — they tell you if things are calm or about to explode.

How to Read Market Events Like a Trader

You don’t need to be a full-time economist — just know what to look for.

- Stay curious, not reactive.

Don’t FOMO into news — wait for confirmation. - Ask: who benefits?

Every announcement helps someone. Figure out who, and you’ll know the direction. - Zoom out.

Most “crashes” are just emotional overreactions.

Example:

Bitcoin drops 8% after a bad news headline.

Two days later, it’s right back up — because nothing fundamental actually changed.

Reality Check: No One Controls the Market (Mostly)

The crypto market is like a giant crowd with ADHD.

Everyone’s guessing, reacting, overreacting.

You can’t control it — but you can observe it calmly while everyone else panics.

That’s your edge.

Your Mission Today

- Pick one major crypto news site (like CoinDesk, The Block, or Decrypt).

- Read a few articles and notice how the market reacted afterward.

- Check the Fear & Greed Index — see what the “crowd mood” is today.

Tomorrow, we’ll zoom back into your chart and talk about risk management, orders, and how to not blow up your account when things go wild.

Next: How Not to Blow Up Your Account