Ad

Join Binance today and start trading!

One of the world’s largest crypto platforms, offering low fees and a wide selection of coins to trade.

BTC Live Price (USDT)

Day 7 – The Trader’s Mindset: Staying Sane in a Crazy Market

You’ve made it this far — congrats.

By now, you can open trades, read charts, and use indicators without getting lost.

But here’s the twist: your biggest enemy isn’t the market… it’s you.

Trading success is 20% strategy, 80% psychology.

Let’s fix the part most beginners ignore — their mindset.

Emotions: The Silent Account Killer

Every trader faces the same four horsemen of emotional disaster:

- Fear: makes you sell too early.

- Greed: makes you hold too long.

- FOMO: makes you enter too late.

- Revenge trading: makes you lose everything trying to win back a loss.

Sound familiar? Yeah, it happens to everyone.

Even pros still fight these emotions — they just learned not to listen.

Discipline Beats Genius

You don’t need to be a genius to win in trading.

You just need to follow your plan when it’s boring and avoid improvising when it’s exciting.

Set your rules — entry, stop-loss, take-profit — before the trade starts.

Then walk away.

If you feel like “just checking one more time”… you’re already losing discipline.

Patience: The Superpower Nobody Talks About

The market doesn’t pay you for effort — it pays you for waiting.

Sometimes the best trade is no trade.

If the setup isn’t clear, don’t touch it.

It’s better to be out of the market wishing you were in,

than in the market wishing you were out.

Thinking in Probabilities, Not Certainties

Trading is not a science; it’s controlled chaos.

You’ll never know for sure what happens next.

Every trade is just a probability bet — and even perfect setups can fail.

Your job isn’t to predict, it’s to manage outcomes.

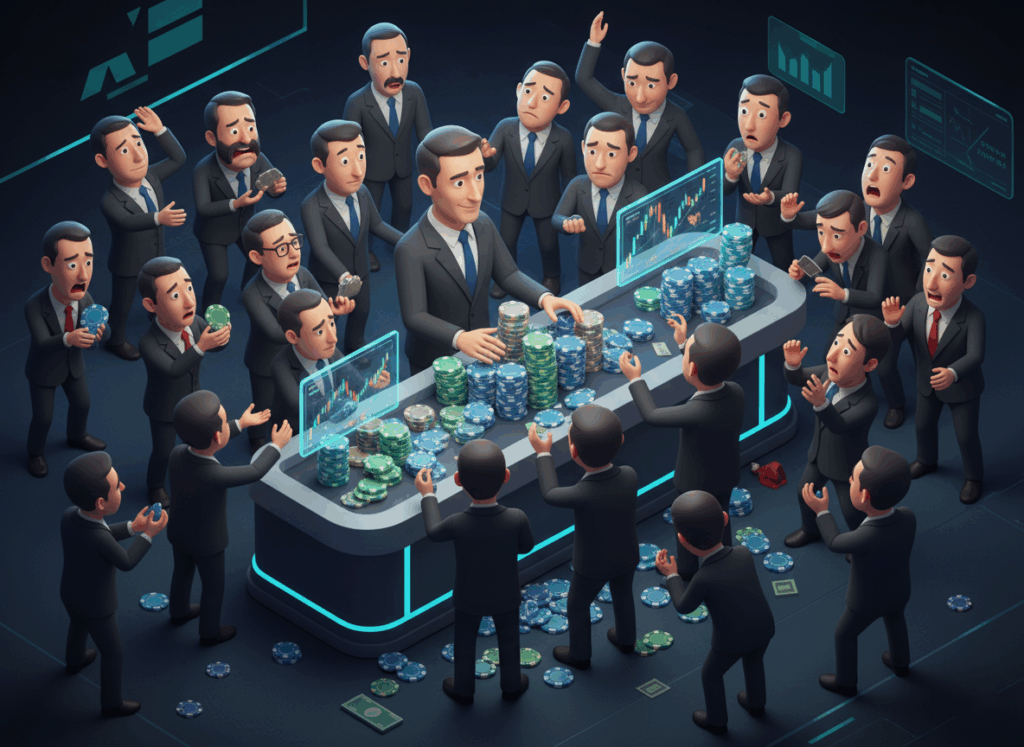

Imagine being a casino:

You don’t care about a few losses — because your edge wins over time.

Surviving Losing Streaks

Losses are part of the game — not proof you’re bad at it.

Even the best traders lose 40–50% of their trades.

What matters is how small you lose and how big you win.

When you hit a rough patch:

- Stop trading for the day.

- Review your trades, not your life choices.

- Remember: consistency beats intensity.

The Long Game

If you’ve read all 7 days, you already know more than most beginners ever will.

But this is just the warm-up.

Real mastery comes from time + journaling + reflection.

Track your trades.

Write what you felt.

Study your mistakes like a detective, not like a victim.

Because once you understand yourself, you’ll finally understand the market

Your Mission Today

- Write your personal trading rules (your code of honor).

- Define your max risk per trade.

- Promise yourself to never trade out of boredom, anger, or greed.

Print it. Keep it near your screen.

That piece of paper will save you more money than any indicator ever will.

🎉 Congratulations — You’ve Completed the Crash Course! 🎉